Gains on the sale of collectibles (e.g.,. The 2025, 2026 and 2027 tax brackets are for future tax years and the final tax rate values will be posted here once.

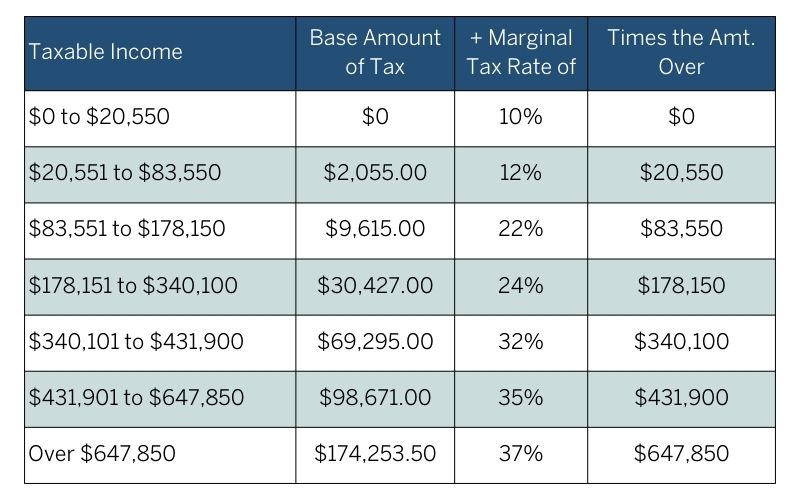

The bracket you’re in depends on your filing status: To figure out your tax bracket, first look at the rates for the filing status you plan to use:

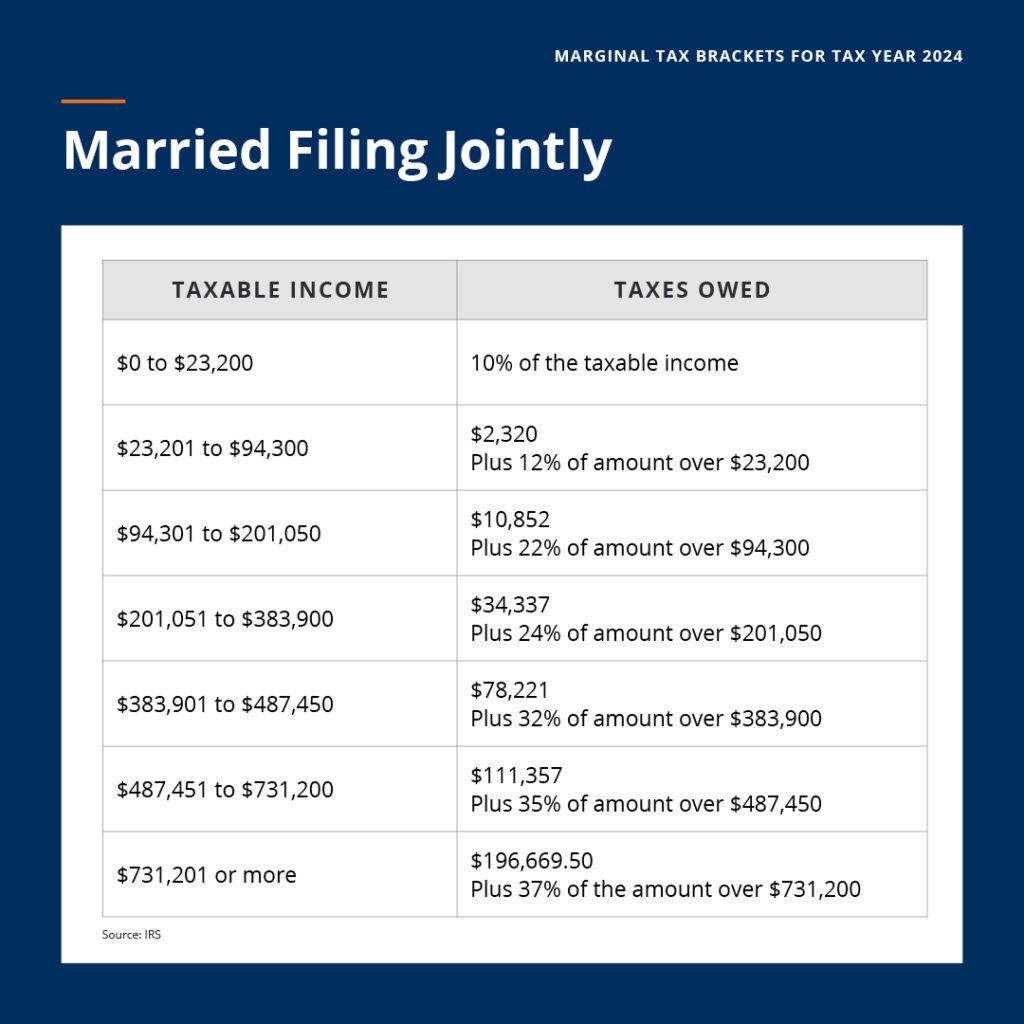

2025 Tax Brackets Married Filing Separately Married Gerta Juliana, Taxable income(married filing separately) taxable income(head of household) 10%: In other words, in 2025, a married couple filing jointly would pay 10% on their first $23,200, then 12% on any additional income up to $94,300, 22% on any.

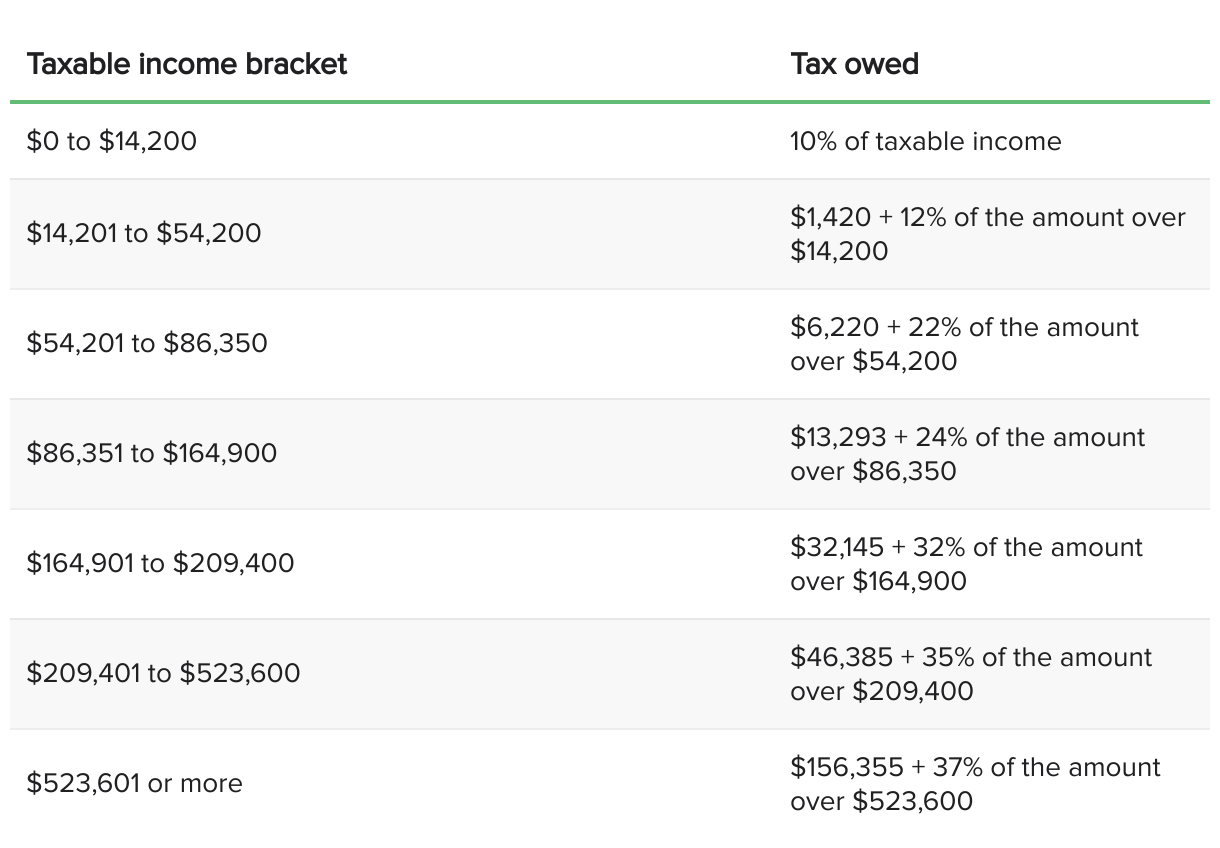

2025 Tax Brackets Married Filing Separately 2025 Klara Michell, Taxable income(married filing separately) taxable income(head of household) 10%: For instance, the 22% tax bracket for single filers applies to $50,650 of income for the 2025 tax year (i.e., income from $44,726 to $95,375), but it applies to $53,375 of income for.

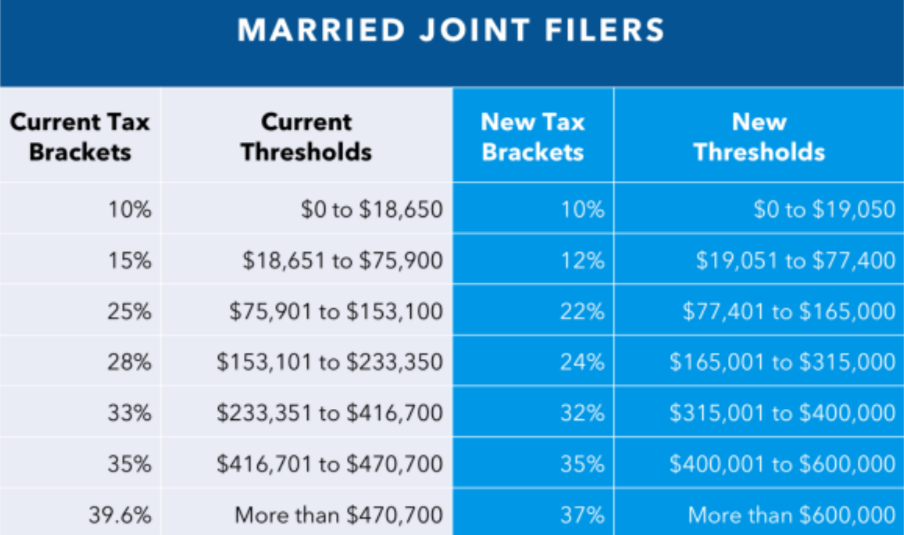

2025 Tax Brackets Announced What’s Different?, Tax rate taxable income (married filing separately) taxable income. For 2025, inflation adjustments increased the size of tax brackets by about 5.4%.

2025 Tax Brackets Married Filing Jointly Irs Shani Melessa, Married filing jointly or married filing separately. The 2025 standard deduction amounts are as follows:

2025 Married Filing Separately Tax Brackets Milly Suzette, Taxable income(married filing separately) taxable income(head of household) 10%: Married couples filing jointly enjoy a tax status where they combine their incomes and file a single tax return.

Tax Brackets 2025 Married Jointly Over 65 Elyse Imogene, For example, the 2025 standard deduction for married filing jointly is $27,700 ($29,200 in 2025) versus just $13,850 ($14,600 in 2025) for married filing separately. Rates for married individuals filing separate returns are one half of the married filing jointly brackets.

2025 Tax Brackets Married Filing Separately 2025 Timmy Giuditta, Single or married filing separately: Individuals with a taxable income of over rs 3 lakh currently have to pay 5% income tax.

IRS Sets 2025 Tax Brackets with Inflation Adjustments, Single, married filing jointly, married filing separately or head of household. Here are projections for the 2025 irmaa brackets and surcharge amounts:

2025 Federal Standard Deduction For Married Filing Jointly Merla Stephie, The tax brackets, standard deduction, and the capital gains tax cutoff point for single and married filing jointly filing statuses will go up in 2025. What is a marginal tax rate?

2025 Tax Brackets Married Filing Separately Married Filing Adele Antonie, When deciding how to file your federal income tax return as a married couple, you have two filing status options: There are seven federal tax brackets for tax year 2025.

For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).