Eligible Hsa Expenses 2025. You can make contributions to your hsa for 2025 through april 15, 2025. An eligible expense is a health care service, treatment, or item the irs states can be paid for without taxes.

On your tax return, you can deduct qualified expenses over $4,500 (7.5% of $60,000). Maximum contribution amounts for 2025 are $4,150 for self.

How to SetUp & Get the Most from a Health Savings Account (HSA), What is a health savings account and how does it work? On may 16, 2025 the internal revenue service announced the hsa contribution limits for 2025.

2025 HSA & HDHP Limits, Written by timalyn bowens, ea. The maximum contribution for family coverage is $8,300.

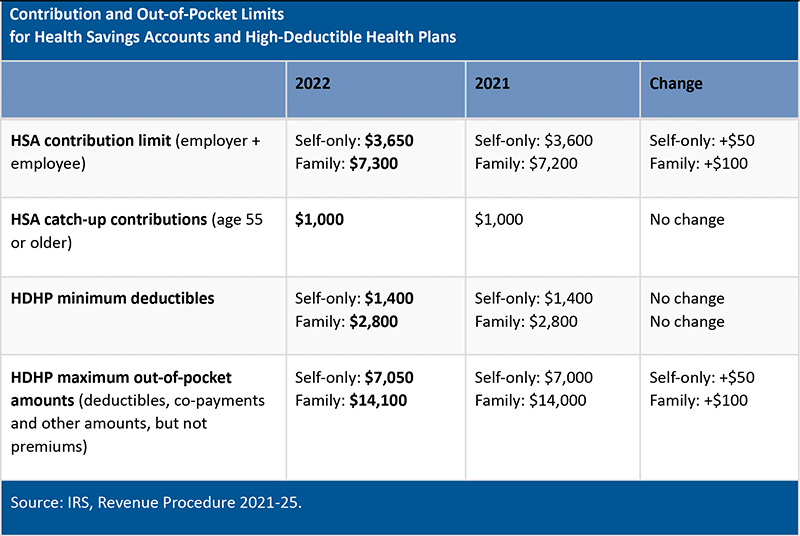

Significant HSA Contribution Limit Increase for 2025, $4,150 for individual coverage ($3,850 in 2025) $8,300 for family coverage ($7,750 in 2025) the irs adjusts hsa contribution limits regularly to account for inflation. On may 16, 2025 the internal revenue service announced the hsa contribution limits for 2025.

New HSA/HDHP Limits for 2025 Miller Johnson, You can see the complete list in irs publication 502, medical and dental expensesopens pdf file. Claiming medical expenses for a person who died.

HSA Eligible Expense List, Am i eligible for an hsa? The new 2025 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2025.

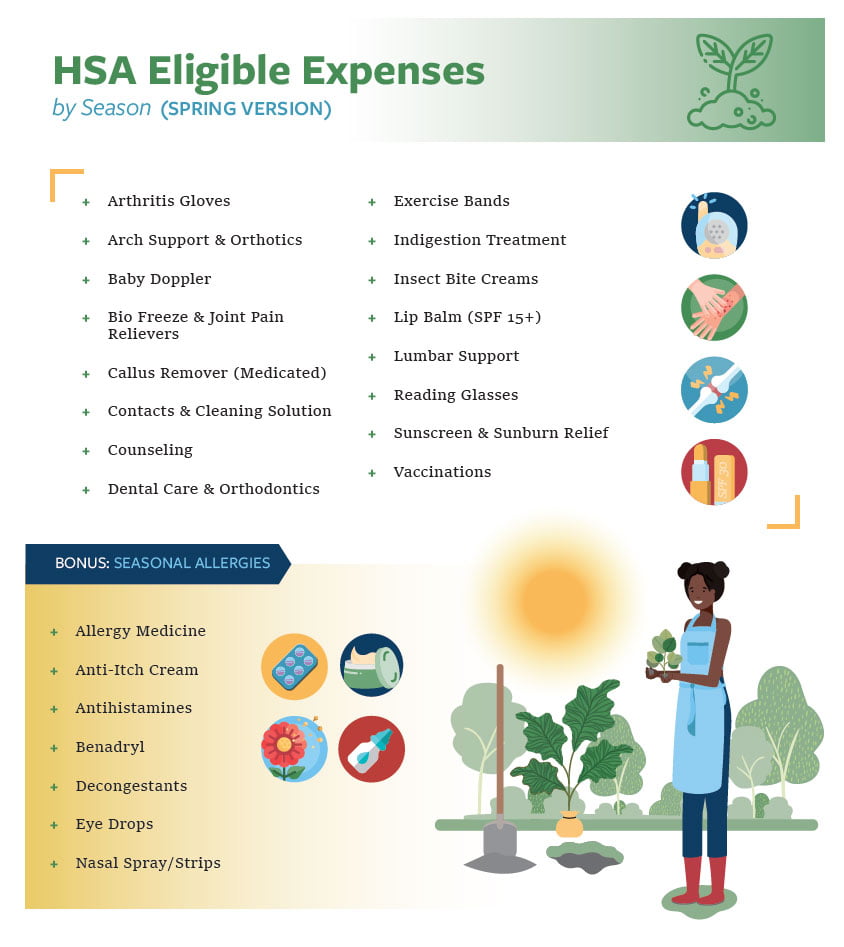

Springtime HSA Eligible Expenses Employee Benefits Management Group, An eligible expense is a health care service, treatment, or item the irs states can be paid for without taxes. Types of expenses that may be included are:

what is fsa/hra eligible health care expenses Judson Lister, Types of expenses that may be included are: What are the hsa contribution limits for 2025?

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Can You Use An HSA To Pay For Medical Supplies?, $4,150 for individual coverage ($3,850 in 2025) $8,300 for family coverage ($7,750 in 2025) the irs adjusts hsa contribution limits regularly to account for inflation. Updated on march 4, 2025.

Eligible Expenses for FSAs, HSAs, and HRAs, The 2025 hsa contribution limit for. An eligible expense is a health care service, treatment, or item the irs states can be paid for without taxes.

IRStable Wilke CPAs & Advisors, View contribution limits for 2025 and historical limits back to 2004. To be eligible, you must have no.

The new 2025 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2025.

Cnn Anchor Salaries 2025. Multiple reports show he has an estimated net worth of $200 million. $29,000 10% $56,236 median $106,000 90%. How much do […]

Red Sox Vs Angels 2025. Live coverage of the los angeles angels vs. 162 games of intrigue, possibility, frustration, and joy await. Angels 7, red […]

Best Savings Rates 2025. Don’t let your money sit stagnant in a savings account that earns less than. Act now to earn up to 5.35% […]