Maximum 401k Contribution 2025 Calculator Ny. For 2025, the limit is $23,000 for those under 50, and $30,500 for those over 50. This 401 (k) calculator is designed to help you estimate how much money you could have in your 401 (k) retirement account by the time you retire.

For 2025, the 401(k) annual contribution limit is $23,000, up from $22,500 in 2025. This depends on the level of earnings from the business, as well as other.

Understanding irs contribution limits is important, especially when your goal is to contribute the maximum to your account.

401k 2025 Contribution Limit Chart, Use this calculator to see how increasing your contributions to a 401 (k), 403 (b) or 457 plan can affect your paycheck as well as your retirement savings. This means that your total 401(k) contribution limit for 2025 is.

Max Annual 401k Contribution 2025 Raina Carolann, Employees can invest more money into 401(k) plans in 2025, with contribution limits increasing from 2025’s $22,500 to $23,000 for 2025. Understanding irs contribution limits is important, especially when your goal is to contribute the maximum to your account.

401k Max Contribution 2025 Roth Lisa Renelle, Even if you can’t do the max, consider. During the 2025 tax year, the 401(k) contribution limit was $500 lower at.

The Maximum 401k Contribution Limit Financial Samurai, In 2025, people under age 50 can contribute. Retirement contribution limits are adjusted annually for.

Roth 401k 2025 Limits Davine Merlina, Employees can invest more money into 401(k) plans in 2025, with contribution limits increasing from 2025’s $22,500 to $23,000 for 2025. In tandem, using tools such as.

401k Max Contribution Limit 2025 Taffy Cristin, For 2025, the 401(k) annual contribution limit is $23,000, up from $22,500 in 2025. This depends on the level of earnings from the business, as well as other.

Simple Ira Maximum Contributions 2025 Nerti Yoshiko, Employees can invest more money into 401(k) plans in 2025, with contribution limits increasing from 2025’s $22,500 to $23,000 for 2025. For 2025, the 401 (k) contribution limit for employees is $23,000, or $30,500 if you are age 50 or older.

What’s the Maximum 401k Contribution Limit in 2025? (2025), This means that your total 401(k) contribution limit for 2025 is. The irs sets a limit on how much can be put into a 401(k) plan every year, also known as an annual contribution limit.

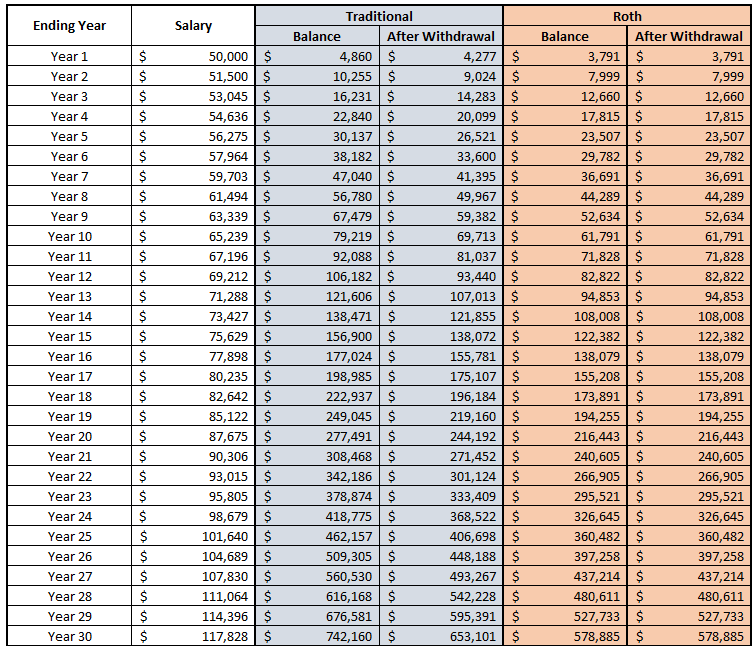

Optimize Your Retirement With This Roth vs. Traditional 401k Calculator!, This depends on the level of earnings from the business, as well as other. They provide invaluable insights and guidance for optimizing contributions, maximizing tax benefits, and saving for retirement.

Total 401k Contribution Limit 2025 Including Employer Ellie Hesther, You may find that your employer matches or makes part of your contributions, as many do. The 401(k) contribution limit for 2025 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions.

The 401(k) contribution limit for 2025 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions.

Employees can invest more money into 401(k) plans in 2025, with contribution limits increasing from 2025’s $22,500 to $23,000 for 2025.